for a mumber of major pet health product brands

The companion animal health sector is the major growth area for the global pet health industry, but returns are still relatively low compared to the human pharmaceutical industry. Moreover, the increased costs of developing and registering pet products has discouraged some companies from investing in long term R&D. Many of the leading pat health companies, which are part or larger human pharmaceutical groups, are thus looking to products that have been developed and registered for human use, and adapting these for companion animals, which often have a similar metabolism. These 'crossover products' avoid long and costly development prngrammes and have already brought about significant changes in the structure or the companion animal products market.

For example, in 1999, arthritis patients were offered a new alternative to established non-steroidal anti-in-flammatory drug treatments when Pharmacia launched Celebrex (celecoxib), the first representative or the new 'coxib' drug subclass. Co promoted with Pfizer. Celebrex became the most successful prescription drug launch in history, racking up global sales or more than $3 billion just two years later. And as the man in the razor commercials might have said, Pfizer liked it so much it decided to buy the company, purchasing Pharmacia in a deal worth around $6O billion.

A decade or so ago, vets would certainly have been interested in Celebrex. and some would have prescribed it on an extra label basis for use in pats. The market for pet medicines has been transformed in terms of both size and sophistication since then, however, and less than three years after Pharmacia rolled Celebrex out in its first markets a coxib drug had been developed and registered specifically for use in dogs. Sold by the pet health subsidiary of Swiss healthcare multinational Novartis, Deramaxx (deracoxib) was approved by US regulators in 2002. It was authorised for the treatment of canine osteoarthritis in February 2OO3, and had captured around a quarter of US sales in that segment by the end of the year.

The coxib story is a neat illustration of just how important the pet market has become to companies operating in the pet health products industry. Major players in the sector have seen their revenues from livestock medicines flatten out or decline as disease scares and concerns surrounding drug residues and antibiotic resistance have affected demand and triggered the introduction of increasingly rigorous regulatory requirements. At the same time. it has become clear that the bond between pets and their owners is such that many will pay hundreds, sometimes even thousands or dollars to ensure that their animals enjoy a long and healthy life.

Responding to both commercial opportunities and demands from the veterinary profession and animal owners, the industry has ploughed an increasing proportion of its research and development budget into the search for novel pet products. Those efforts have already borne considerable fruit, resulting in the commercialisation of novel parasite control products and drugs indicated for use in the treatment of conditions such as heart disease, diabetes, age-related disorders, and even behavioural problems.

Novartis, which handles the Deramaxx canine arthritis treatment, is one of four top-20 animal health companies that now market ACE inhibitors for use in the treatment of canine heart disease. The Swiss company's pet pro duct range also includes canine versions of the antidepressant, Anafranil (clomipramine), and the immunosuppressant, Neoral (cyclosporin).

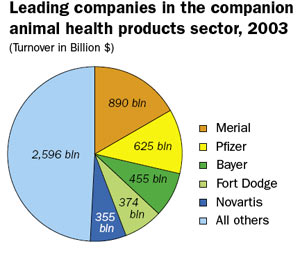

Merial, which currently vies with Pfizer for outright leadership of the animal health products market, also includes a canine ACE inhibitor in its range, and recently added a veterinary version of the blockbusting antiulcer drug, Losec, to its companion animal portfolio. But the jewel in Medal's pat crown is undoubtedly its pet flea/tick control, Frontline (fipronil), which generated global sales of $576 million in 2OO3.

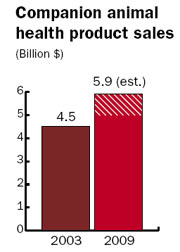

Frontline has emerged as the most successful brand in a world market for companion animal parasite controls that is currently valued at over $2.7 billion. With other pharmaceutical treatments generating global revenues or around $1.7 billion and sales of vaccines and diagnostics worth more than $8OO million, the world market for companion animal health products is valued at some $5.3 billion. Sales or products for use in dogs, cats and other small pet species dominate the sector, realising sales of $4.5 billion equivalent to almost one-third or the entire global market for animal health products.

Like Medal, most other leading players in the companion animal health products market possess a significant stake in the parasite control segment. Portfolios are being broadened progressively, however, as companies attempt to unlock the potential of other, more specialist fields. Products for use in companion animals now ac count for more than half of the revenue totals posted by Merial, Bayer and Novartis, and are expected to claim an increasing share or other animal health company sales in future.

Patents on a number of major pet product brands are set to expire in the next five years, and generic drug manufacturers will be keen to cash in on their success. But leading companies in the sector continue to invest heavily in the research and development or new products for use in pets, and the range of health problems treatable with veterinary approved drugs will continue to expand as those efforts bear fruit.

Treatments for cancer, which is now the leading disease related cause of mortality in the US dog population, are among those currently being researched. Obesity and a range of age-related conditions are also being addressed, while the control of reproduction in pets is set to be transformed by new product offerings. Hormone based alternatives to surgical spaying or castration have already begun to reach the market, while several companies are working on the development of contraceptive vaccines.

The market for effective alternatives to surgical castration/spaying is expected to be worth around $100 million in the US alone, while companies reaching the market with successful cancer treatments can expect a considerably bigger pay day. So while generics will increase levels of competition for more established pat health products, the sector as a whole is set to continue increasing in value.

The information in this article is taken from two Animal

Pharm reports: Companion Animals: A new market for human pharmaceuticals and insecticides (ref SR225) and Companion Animals: Prospects for a growth market (ref SR231), both priced €795/$670.

For further information:

www.animaipharmreports.com

email: animalpharmreports@pjbpubs.com

Source: PETS International Magazine

HOME - About PetsGlobal.com - Pet Industry Links - Update my company - Contact PetsGlobal.com

© 2001-2025 PetsGlobal.com All right reserved